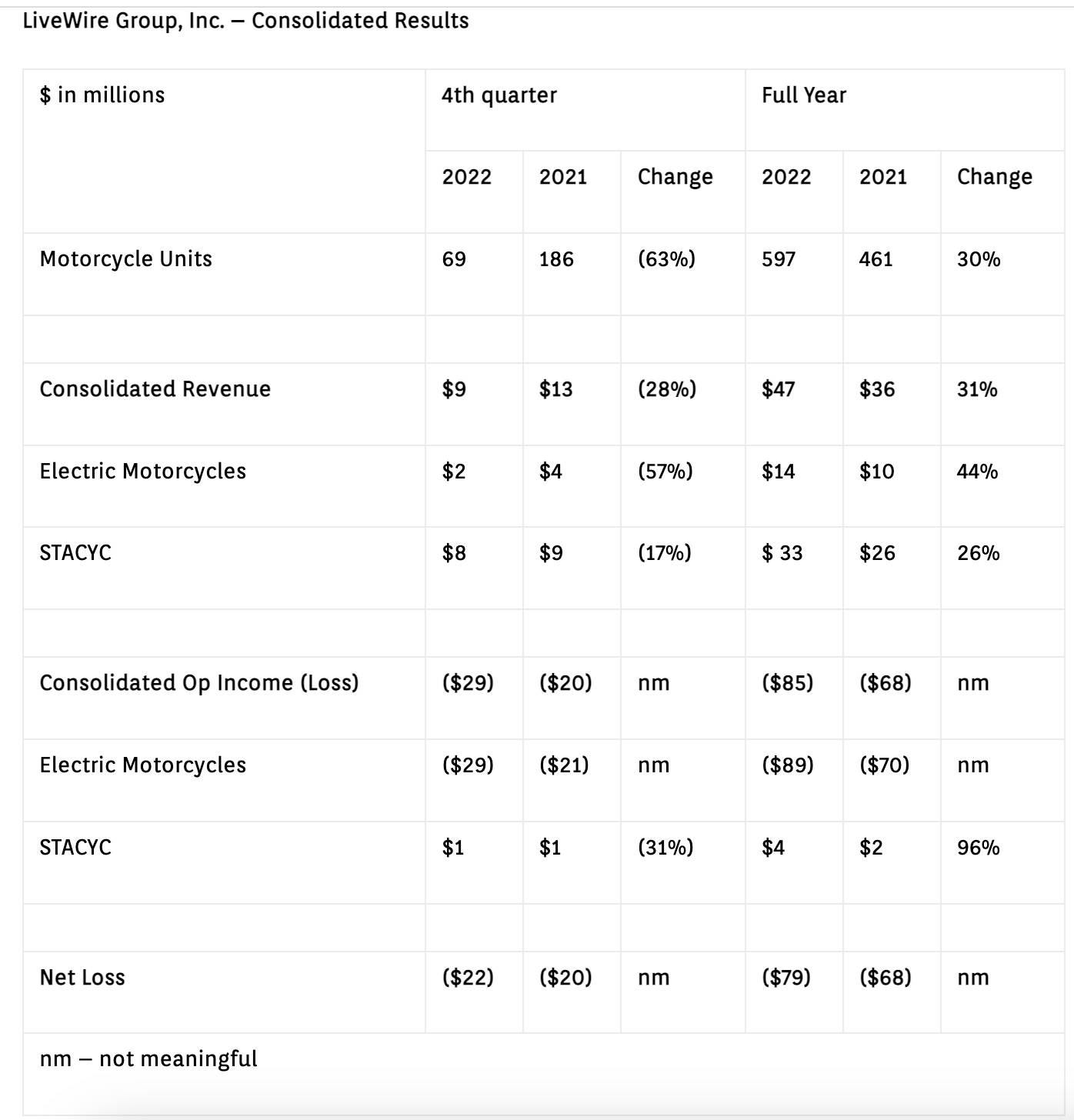

LiveWire Group, Inc. (“LiveWire”) (NYSE: LVWR) has reported its Q4 and full year 2022 results. LiveWire electric motorcycle revenue was down 57% in the fourth quarter, due to lower unit sales. STACYC balance bike revenue was down 17% in the fourth quarter, due to timing of wholesale shipments. However STACYC revenue was up 26% for the full year driven by the launch of new 18- and 20-inch electric balance bikes.

“2022 saw a significant milestone in LiveWire’s journey with the company becoming the first listed electric motorcycle company on the NYSE,” said Jochen Zeitz, Chairman and CEO, LiveWire. “For 2023, investment into product development continues to be at the top of our priority list; advancing the technologies, platforms and products that will further our position as pioneers of the industry.”

“We’re excited to continue building the LiveWire brand globally, and in 2023 we expect to see the introduction of LiveWire ONE to the European market and the launch of the S2 platform,” added Ryan Morrissey, President, LiveWire. The LiveWire Group is currently comprised of two separate business segments:

Electric Motorcycles – a business segment focused on the sale of electric motorcycles & related products

STACYC – a business segment focused on the sale of electric balance bikes for kids & related products

Electric Motorcycles

Electric Motorcycles revenue was down 57% in the fourth quarter, due to lower unit sales. The fourth quarter of 2021 was higher than normal due to wholesale units invoicing to dealers to start the early build out of the U.S. retail network. Revenue was up 44% for the full year, driven by increased unit sales.

Increased operating losses versus 2021 in both Q4 and total annual was driven by the increase in product development investment needed to advance the electric vehicle systems and deliver the S2 platform. Operating losses also incorporate the added cost of standing up a new organization, including growing headcount.

2022 Business Highlights

• Completed the carve-out and stand-up of LiveWire as separate public company

• Sold 597 LiveWire electric motorcycles, ahead of expectations

• Nearly doubled the reach of the U.S. retail network to 75 contracted partner locations

• Delivered STACYC revenue growth of 26% with successful launch of two new products

• Continued development of the S2 platform with production of Del Mar planned for 2023

• On track to expand distribution of LiveWire into Europe in 2023

STACYC

STACYC revenue was down 17% in the fourth quarter, due to timing of wholesale shipments. Revenue was up 26% for the full year driven by favorable product mix including the launch of new 18- and 20-inch electric balance bikes. STACYC operating income for the fourth quarter decreased 31%, driven by lower volume due to timing of wholesale shipments. Operating income for the full year improved 96%, driven by increased revenue and margin mix.

2023 Financial Outlook

For the full year 2023, the LiveWire Group expects:

Electric Motorcycle wholesale units of 750 to 2,000

LiveWire Group Operating Loss of $115 to $125 million

Liquidity

To support future ongoing operations, LiveWire is said to have the following available liquidity:

Cash and cash equivalents at 2022 year-end of $265 million

A non-binding $200 million loan facility with majority shareholder