RumbleOn, Inc. (NASDAQ: RMBL), announced results for its Q4 and full year ended December 31, 2023 this week, revealing the group had raised $100 million through rights offering and paid down $50 million in debt. ”During the quarter, we were able to accomplish several capital and balance sheet initiatives that put us in a favorable position to start 2024, including successfully completing a $100 million rights offering, selling non-core assets, making significant progress to integrate our prior acquisitions, right-sizing pre-owned inventory values and reducing term debt,” noted new CEO Mike Kennedy.

“While we believe that the prior Adjusted EBITDA guidance of $80 million to $90 million for 2024 is within our sight, we have decided to stop the practice of giving annual guidance. Instead, we'll point investors to our Vision 2026 plan and how we expect to be able to shape the business to drive per share value over the coming years,” he added. “As a result, we are withdrawing prior guidance for 2024."

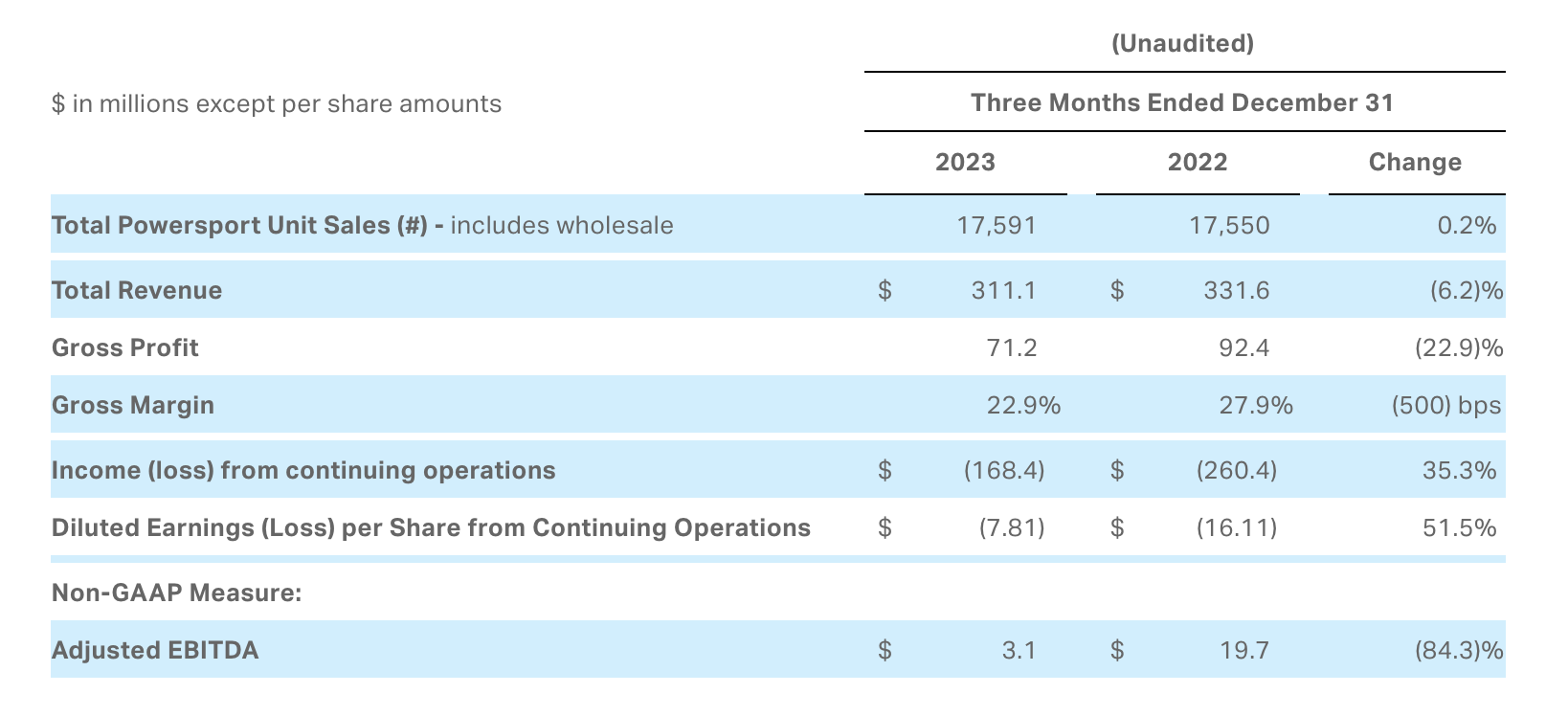

FOURTH QUARTER 2023 - TOTAL COMPANY RESULTS

Total Powersport Units Sold: 17,591, increased 0.2%.

Total Revenue: $311.1 million, declined 6.2%, due to lower selling prices on powersports vehicles sold.

Total Gross Profit: $71.2 million, down $21.2 million from the prior year, of which $12.6 million related to a fourth quarter pre-owned inventory adjustment for certain pre-owned vehicles that were purchased proactively at premium prices during a challenging supply chain environment resulting from the COVID-19 pandemic. As demand has reached more pre-COVID-19 normalized levels, powersports vehicles acquired at inflated prices during that time period were written down to their net realizable value.

Operating Expenses: $80.5 million, or 25.9% of revenue, compared to $96.2 million, or 29.0% of revenue. Total stock-based compensation was $1.1 million, or $1.0 million lower.

Loss from Continuing Operations: $168.4 million, including a $60.1 million pre-tax non-cash goodwill and franchise rights impairment charge. Loss per diluted share was $7.81 compared to $16.11.

Adjusted EBITDA: $3.1 million compared to $19.7 million. The decrease in Adjusted EBITDA was primarily driven by lower selling prices and compressed margins in the Powersports Segment.

Cash as of December 31, 2023, including restricted cash, was approximately $77.0 million, and non-vehicle net debt was $242.9 million. Availability under the Company's Powersports inventory financing credit facilities totaled approximately $135.6 million.

Total Available Liquidity, defined as cash and cash equivalents, including restricted cash, plus availability under Powersports inventory financing credit facilities totaled approximately $212.6 million.

“We are proud of what the RumbleOn team has accomplished in such a short period and are confident that the foundation that we built positions us well to implement and deliver our plan,” claims Kennedy. "We expect the following to be achieved by calendar year 2026, while maintaining a healthy balance sheet within our target ratio of 1.5x to 2.5x net debt/Adjusted EBITDA:

Annual revenue in excess of $1.7 billion,

Annual Adjusted EBITDA of greater than $150 million

Annual Adjusted Free Cash Flow of $90 million or more

“While we believe that the prior Adjusted EBITDA guidance of $80 million to $90 million for 2024 is within our sight, we have decided to stop the practice of giving annual guidance,” Kennedy continued.” Instead, we'll point investors to our Vision 2026 plan and how we expect to be able to shape the business to drive per share value over the coming years. As a result, we are withdrawing prior guidance for 2024."

About RumbleOn

RumbleOn, Inc. (NASDAQ: RMBL), operates through two operating segments: the RideNow Powersports dealership group and Wholesale Express, LLC, an asset-light transportation services provider focused on the automotive industry. RideNow Powersports is the largest powersports retail group in the United States (as measured by reported revenue, major unit sales and dealership locations). RideNow Powersports sells a wide selection of new and pre-owned products, including parts, apparel, accessories, finance & insurance products and services, and aftermarket products. We are the largest purchaser of pre-owned powersports vehicles in the United States and utilize our proprietary Cash Offer technology to acquire vehicles directly from consumers. To learn more, click here:

https://www.rumbleon.com