Noting the 2022 Net loss was $287.7million, Marshall Chesrown, RumbleOn's Chairman and CEO commented, "Our fourth quarter results reflect forward-looking actions taken to better position the business for 2023 and beyond. We are aggressively addressing macroeconomic uncertainties, as we operate in an environment of normalized inventory levels and associated margin pressures."

He claims, "We are building a solid foundation for long-term profitable growth, all while making prudent, timely and disciplined investments in technology and customer experience improvements online and in our stores. Further, the fulfillment process being rolled out will enable our operations and teams to become more agile to meet customer demand through diligent on time inventory management and customer selection and service."

"With an ongoing focus on maintaining financial health and a strong balance sheet, we remain committed to a completely self-funded business model for growth. In the fourth quarter, we pre-paid $15M in principal and recently signed an engagement letter with JP Morgan to review our balance sheet initiatives and options for 2023. As we look to 2023 and beyond, we are continuing to implement our five pillar strategy to achieve our near and long term financial targets, driving sustainable shareholder value," concluded Chesrown in an investor call on Thursday, March 16.

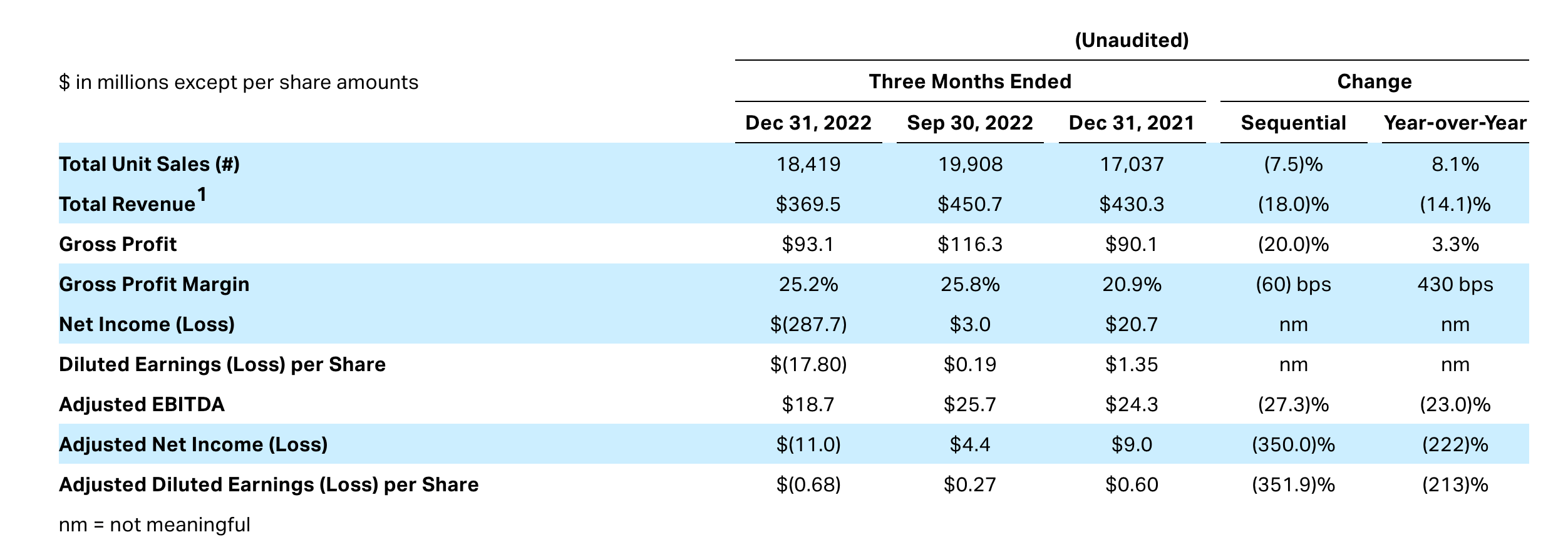

CHART #1

Total Unit Sales of 18,419 declined (7.5)%, driven by the Company's strategic decision to purchase fewer automotive units during the quarter, combined with the anticipated seasonal impact experienced in Powersports. The Powersports Segment made up approximately 95.3% of total unit sales in the fourth quarter with the Automotive segment comprising the remaining approximately 4.7%.

Total Revenue of $369.51 million declined (18.0)%. The Powersports Segment revenue made up approximately 86.8% of total revenue in the fourth quarter, the Automotive Segment made up approximately 10.2%, and the Vehicle Logistics Segment made up approximately 3.0%.

Total Gross Profit of $93.1 million declined (20.0)%. The Powersports Segment contributed approximately 96.4% of total gross profit in the fourth quarter, and the Vehicle Logistics and Automotive Segments made up approximately 2.9% and 0.7%, respectively.

Operating Expenses were $98.1 million, or 26.6% of revenue, compared to $102.8 million, or 21.9% of revenue. Total stock-based compensation was $2.1 million down from $2.6 million in the prior quarter.

Net Loss was $(287.7) million, reflecting a $350.3 million pre-tax non-cash impairment charge. Earnings (loss) per diluted share was $(17.80) compared to $0.19.

Adjusted Net Income (Loss) was $(11.0) million, or 3% of revenue, compared to $4.4 million or 1% of revenue. Adjusted earnings per diluted share was $(0.68) compared to $0.27.

Adjusted EBITDA was $18.7 million compared to $25.7 million. The (27.3)% sequential decrease in adjusted EBITDA was primarily driven by modest gross margin compression in the Powersports Segment and lower gross profit contribution from the Automotive Segment.

Cash as of December 31, 2022, including restricted cash, was approximately $58.6 million, and total debt was $635.2 million. Availability under our short-term revolving credit facilities totaled approximately $137.5 million. Total Available Liquidity, defined as cash and cash equivalents, including restricted cash, plus availability under our short-term revolving credit facilities totaled approximately $196.1 million.

Cash Flow used in Operating Activities was $(18.9) million for the year ended December 31, 2022, which was negatively impacted by $45.1 million of cash used for inventory purchases not financed by trade floorplan credit facilities.

Weighted Average Basic and Diluted Shares of Class B common stock outstanding were 15,871,005 for the year ended December 31, 2022. As of December 31, 2022, RumbleOn had 16,184,264 total shares of Class B common stock and 50,000 shares of Class A common stock outstanding.

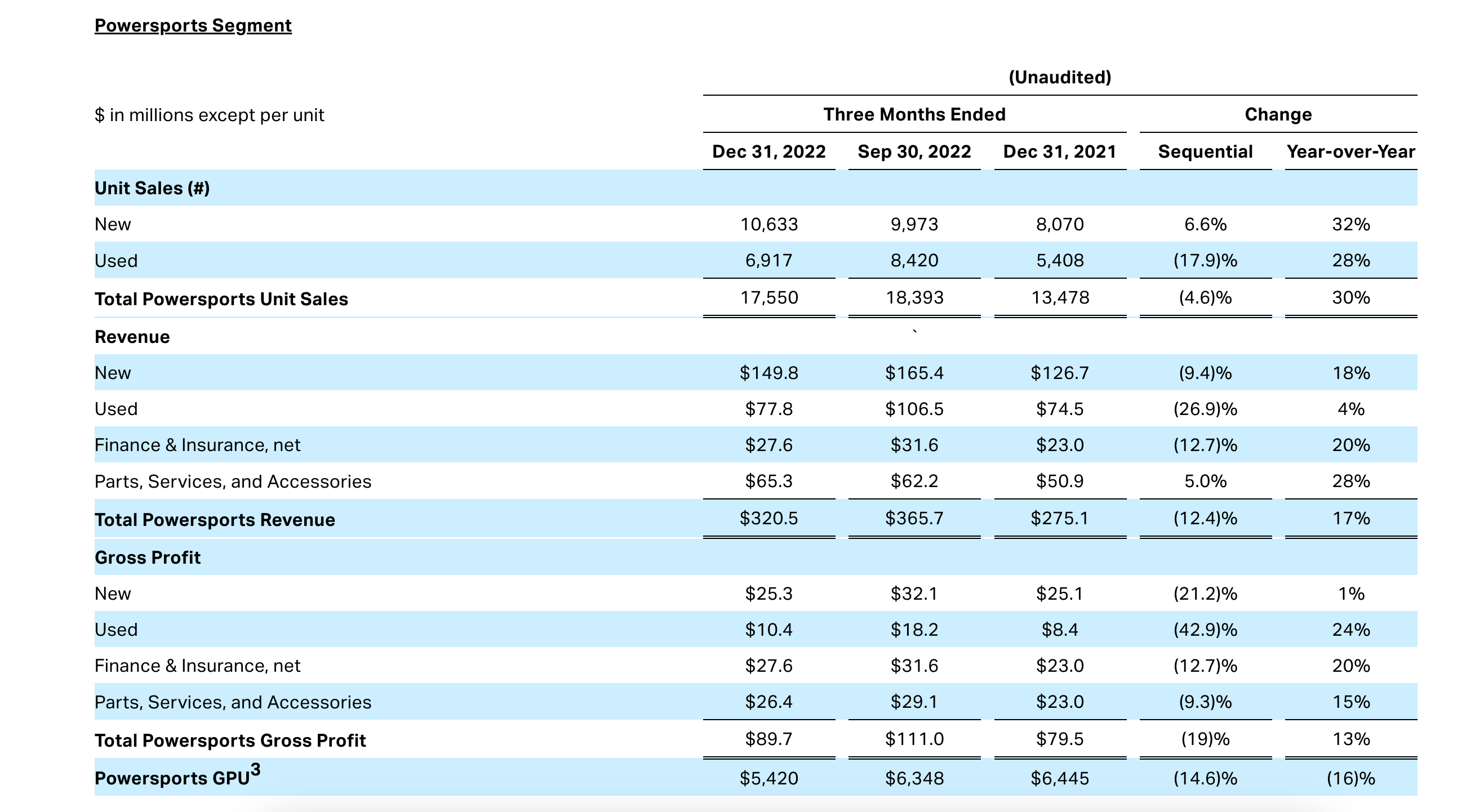

CHART #2

Used Powersports Units, which includes used retail and wholesale Powersports Units, declined (17.9)% sequentially. Sequential declines are primarily the result of our decision to slow down used vehicle acquisition while new inventory normalized.

Used Powersports Revenue declined (26.9)% sequentially due to anticipated seasonality. Used Powersports Gross Profit declined (42.9)% sequentially, due primarily to lower unit sales and anticipated seasonality.

New Powersports Revenue declined (9.4)% sequentially, despite a 6.6% increase in unit sales, driven by increased supply of new inventory and unfavorable price mix in consumer demand. New Powersports Gross Profit declined (21.2)% sequentially, due primarily to higher inventory acquisition costs.

Powersports GPU was $5,420, as compared to $6,348 in the prior Q3.