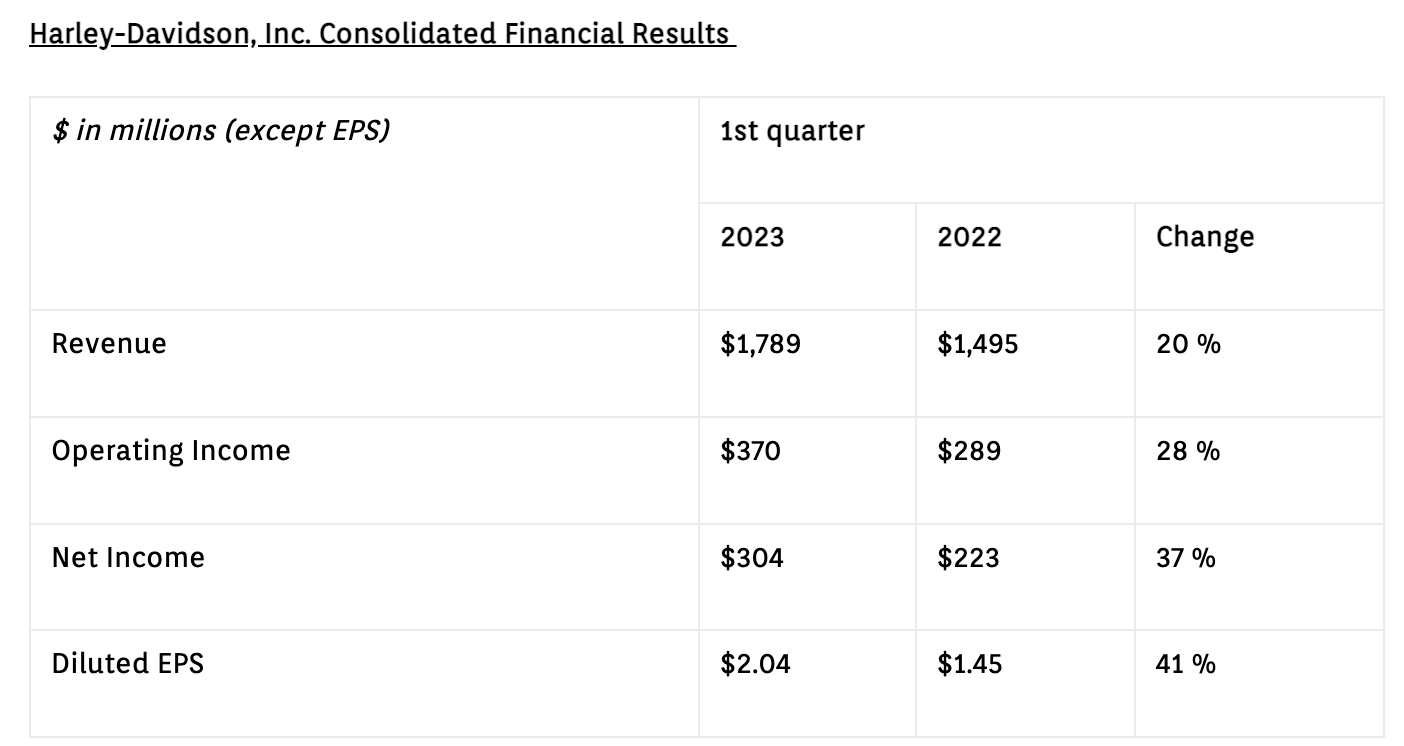

Despite Harley-Davidson Financial Service finishing down 32% for the first quarter, The Motor Company is on track, according to management. “Harley-Davidson delivered a solid start to the year, with consolidated first quarter revenue up 20%, driven by HDMC, reflecting the progress we continue to make in advancing our Hardwire strategic plan,” proclaimed Jochen Zeitz, Chairman, CEO and President, Harley-Davidson. “Building on our commitment to innovate in our core categories, yesterday’s kick-off of a new era of CVO touring bikes, with the all new 2023 CVO Street Glide and CVO Road Glide, is a landmark for the Company and our customers.”

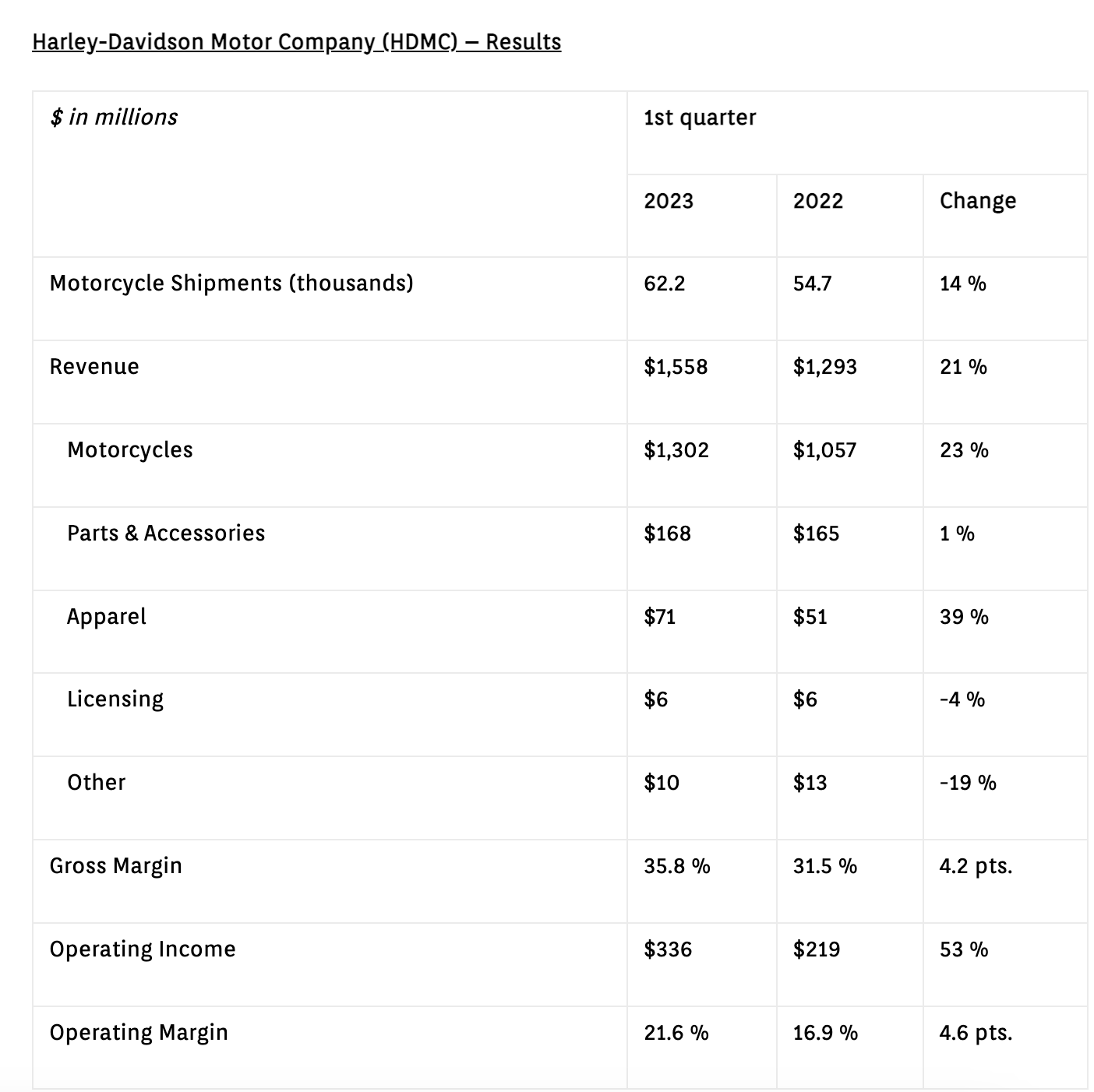

On the positive side of the ledger, Q1 global motorcycle shipments increased 14% in advance of the key riding season. Revenue was up 21% driven by the increase in wholesale shipments and continued global pricing realization. Parts & Accessories revenue was up 1% driven by pricing, while Apparel revenue was up 39% with sales of 120th anniversary merchandise.

First quarter gross margin was up 4.2 points behind pricing, shipment mix, and cost productivity more than offsetting the negative impacts from foreign currency and cost inflation. First quarter operating income margin improved by 4.6 points largely due to the factors above.

First Quarter 2023 Highlights & Results

• Delivered diluted EPS of $2.04, up 41 percent versus prior year

• HDMC Revenue was up 21 percent versus prior year behind wholesale shipment growth, favorable unit mix and global pricing realization

• Achieved HDMC Operating Income margin of 21.6%, an increase of 4.6 points versus prior year, as pricing, unit mix and cost productivity more than offset inflation

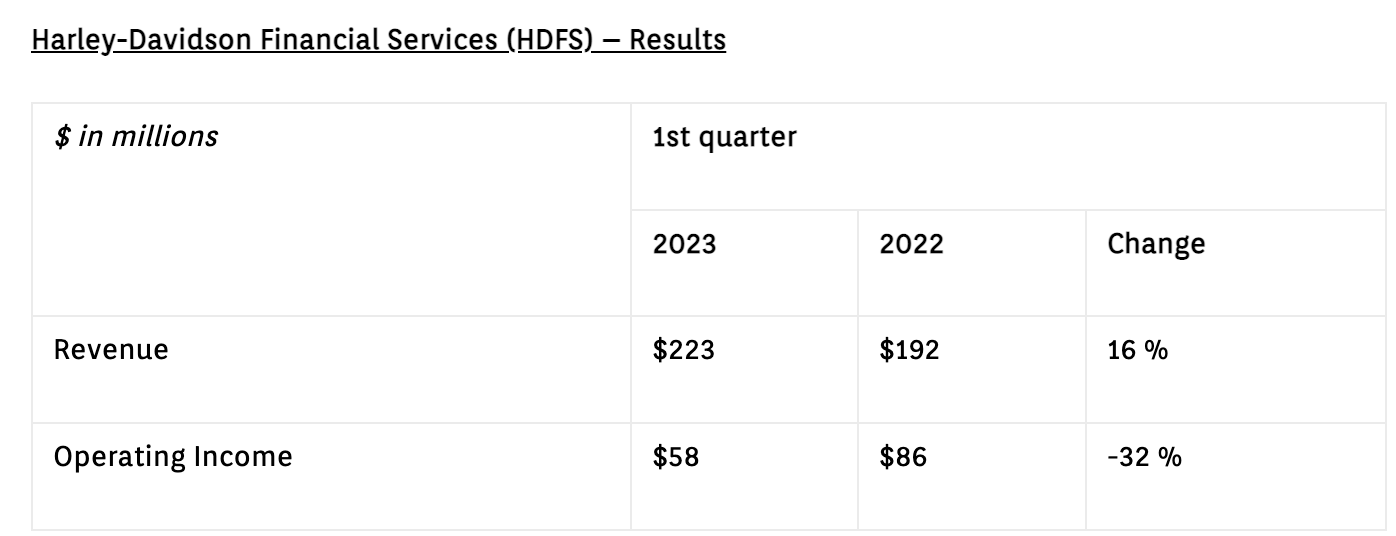

• HDFS operating income finished down 32% on higher interest expense and higher credit losses

• Repurchased $84 million of shares (2.0 million shares) on a discretionary basis

Consolidated operating income in the first quarter was up 28%, driven by an increase of 53% at HDMC, a decline of 32% at HDFS, and an operating loss of $25 million in the LiveWire segment. Consolidated operating income margin in the first quarter was 21% relative to 19% in the first quarter a year ago, representing a 132 basis-point improvement.

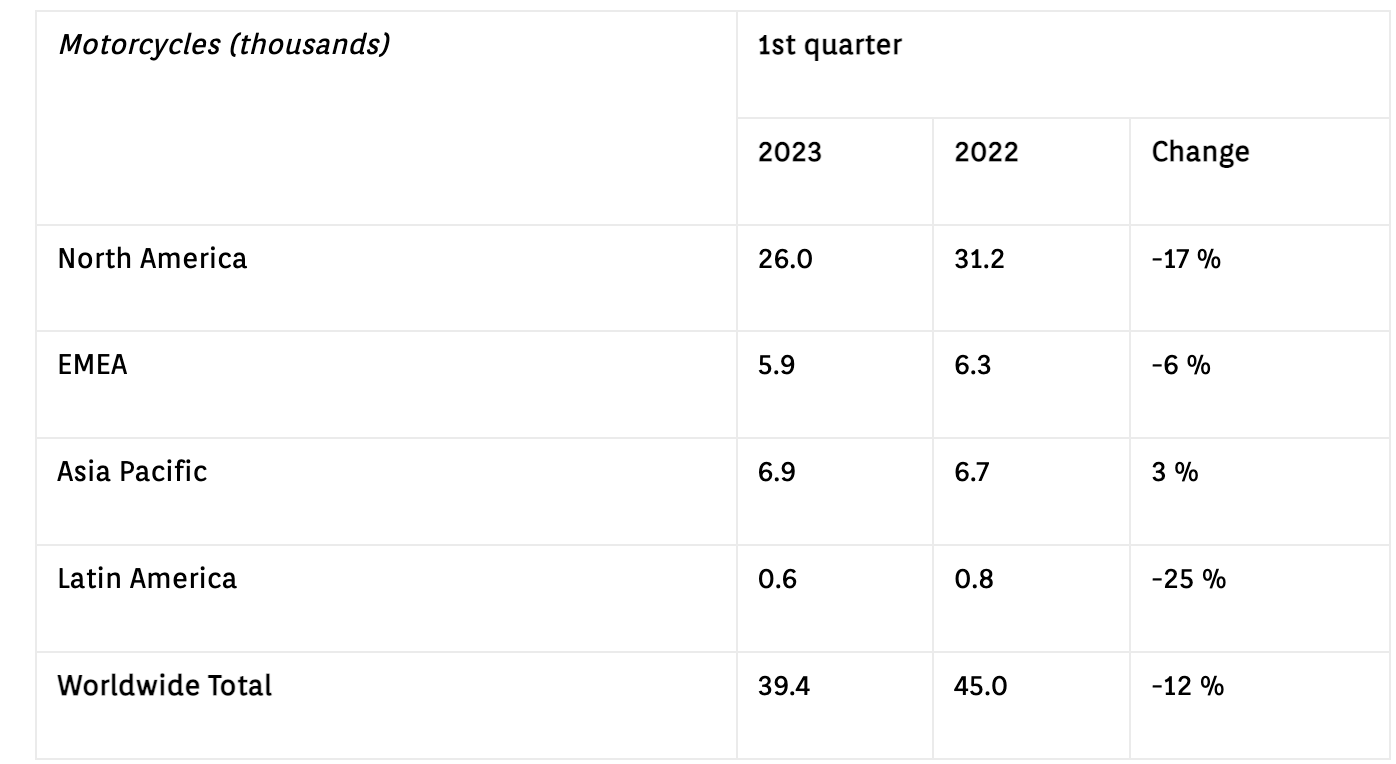

On the down side of the ledger, global retail motorcycle sales were down 12% versus prior year. North America retail performance was down 17%, driven by the timing of new product launches, as well as the shifting macro conditions. Growth in Asia Pacific was driven by continued strong demand across key markets, including Japan and Australia. EMEA decline of 6% was primarily driven by market exits, in addition to a planned unit mix shift towards the profitable core product segments, following the sunsetting of Sportster. Latin America continued to be adversely impacted by regional economic conditions.

Bottom Line For HDFS

HDFS’ operating income declined $28 million in the first quarter, down 32%. This was driven by higher interest expense and higher credit losses. The increase in credit losses was driven by several factors relating to the current macro environment. Total quarter ending financing receivables were $7.6 billion, which was up 11% versus prior year, driven primarily by an increase in wholesale receivables.